How does inflation impact a business, and how can you build an inflation-proof business by making critical changes to boost revenue? The reasons and the remedies might surprise you, but they can be critical to preparing for inflation and surviving its impact. In fact, how your company reacts to small business inflation can become a sustainable competitive advantage! Here’s how:

Is inflation ever normal?

In less turbulent economic conditions, inflation is a normal and manageable fact of business life. In short, small business inflation can be defined as:

A continual rise in the pricing of goods and services.

Of course, inflation impacts buying power for the consumer, too. When inflationary price increases across the economic landscape are small and expected, preparing for inflation is somewhat easily accomplished in one (or both) of two ways:

1. Raising prices of products and services to cover the cost of goods and cost of operations

2. Cutting source material and/or operating costs

It’s when unexpectedly high inflation prevails that businesses often lack the confidence and agility to respond.

How Does Inflation Impact a Business?

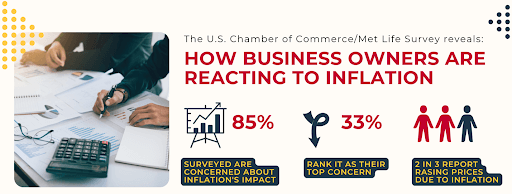

Preparing for inflation and executing steps for protection against inflation first requires understanding how inflation impacts businesses. Again, in stable economic times, inflation is less troublesome for business owners. In fact, research shows that inflation barely registers as a concern for most. But when inflation spikes, worry grows.

Specific Small Business Inflation Challenges

Inflation certainly brings its share of big-picture concerns. It can also manifest with specific challenges which may include:

- Higher costs of goods as suppliers raise prices

- Supply chain disruptions as normal supplier staffing and operations are affected

- Higher operating costs via increased overhead throughout the company

- Tighter margins if prices for the company’s goods and services lag behind price increases by suppliers

- Higher interest rates for new debt

- Customer dissatisfaction and/or defection

- Reduced sales or market share, especially if the company’s goods or services are seen as non-essential in the marketplace

- Painful cost cutting, including operating costs – which may require staff or benefit reductions

How Inflation Impacts Businesses … Positively

Although inflation is often seen (rightly so) in a negative light, it can spawn some positive outcomes as well. These include:

- Existing debt becoming more economical compared to new debt

- Margins on current inventory improving if prices increase on sold goods

- Higher profits if increased prices and reduced costs more than account for cost of inflation

- Identification of areas for performance improvement and cost reduction opportunities throughout the business operation

How to Respond to and Protect Against Inflation by Focusing on Sales

After cutting costs and raising prices, what can the small business owner do to turn inflation’s business impact into a competitive advantage? One way is to focus on sales. Here are some strategic and tactical ways to make sure your sales operation can be more effective, efficient, and profitable in response to inflationary influences:

Enhance Your Sales Plan

A new economic landscape can change industries and marketplaces almost overnight. Is your Sales Plan still relevant? If you’re not sure, take steps to:

- Leverage business intelligence to increase your sales growth rate

- Create the sales organization that fits your sales objectives

- Build the proper compensation model to drive desired behavior

- Hire the needed sales resources

Improve Your Sales Process

Does your current sales process still work in the altered competitive landscape? If not, be sure to:

- Include customized sales cycle steps that fit your company and industry

- Produce predictable sales forecasting

- Create rules of engagement that are understood by everyone

- Implement sales force automation to streamline your processes

Execute and Grow Sales

Beyond strategy and processes, empower your sales operation by:

- Managing your sales team and holding them accountable

- Precisely defining goals for sales and business growth potential

- Creating/utilizing forecast and pipeline management tools

- Developing sales metrics to measure key sales objectives and daily activities

For a clearer picture of how inflation impacts businesses and how to “inflation-proof” your business, download our infographic.

If you’d like to discuss the improvement you’re looking for in your sales process, contact me at

Chris @ Sales Growth Advisors or book a call through my Scheduling Tool.

I also invite you to follow me on LinkedIn to gain exposure to future article posts that will offer more valuable selling insights.

TAKE MY SALES AGILITY ASSESSMENT

——————————————————————————————————————————

I am part of a national group of Senior Sales Leaders who collaborate to share insights like the examples shown in this article. We formed because of our shared passion to help business leaders exponentially grow their revenue.

Chris Tully

President | Sales Growth Advisors LLC

(Phone) 571-329-4343

(Email) crtully@salesgrowthadvisor.com

(Schedule) Here is my calendar link!

(Web) www.salesgrowthadvisor.com

(Blog) https://www.salesgrowthadvisor.com/insight/blog/

Leave A Comment